Understanding Your Payslip:

What “Loading,” “Super,” and “YTD” Mean

Your first payslip has arrived! It’s exciting to see your hard work turn into actual money, but it can also be confusing. You might see terms like “Loading,” “Super,” and “YTD” and wonder what they all mean. This guide will break down a typical payslip using a Coles sample to help you understand exactly where your money is going.

Decoding Your Payslip

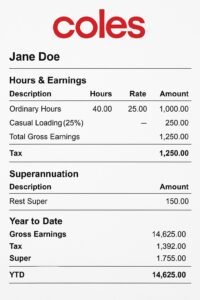

Below is a sample payslip for a fictional Coles employee named Jane Doe. We’ll use this to explain the key sections you’ll find on your own payslip.

-

Hours and Earnings

This section details how your pay is calculated for the pay period.

Ordinary Hours: This is the number of regular hours you worked, multiplied by your base rate of pay. In our example, Jane worked 40 hours at $25 per hour, earning $1,000.

Casual Loading: If you are a casual employee, you will see a “loading” amount on your payslip. This is an extra payment—usually 25% of your base rate—that is paid to you to compensate for not receiving benefits such as paid sick or annual leave 1. In Jane’s case, her 25% loading on her $1,000 of ordinary earnings comes to $250.

Casual loading exists because casual employees don’t receive the same entitlements as permanent employees. You don’t get paid if you’re sick, you don’t accrue annual leave, and you don’t have guaranteed hours. The loading is meant to make up for these missing benefits.

Total Gross Earnings: This is your total pay before any tax or other deductions are taken out. It’s the sum of your ordinary hours, loading, and any other allowances or overtime you may have earned. In this example, Jane’s gross earnings are $1,250.

-

Tax

This is the amount of income tax that your employer has withheld from your pay and sent to the Australian Taxation Office (ATO) on your behalf. The amount of tax you pay depends on how much you earn and what you have declared on your TFN declaration form.

In our example, the tax amount shown is the deduction from the gross earnings. This tax is calculated based on the ATO’s tax tables and is sent directly to the government. At the end of the financial year, when you lodge your tax return, you may receive some of this money back as a tax refund if you’ve paid too much.

-

Superannuation (Super)

This section shows the amount of superannuation your employer has contributed to your super fund for the pay period. Super is a mandatory retirement savings contribution, and for most employees, it is currently 12% of their ordinary time earnings 2. This money is paid in addition to your wages; it is not deducted from your gross earnings.

In the example, you can see that Jane’s employer has contributed $150 (12% of her $1,250 gross earnings) to her Rest Super account. This money goes straight into her super fund and is invested for her retirement.

-

Year to Date (YTD)

The “Year to Date” (YTD) section is a running total of your earnings and deductions since the start of the financial year (July 1st). This is a valuable feature that helps you track how much you’ve earned and how much tax you’ve paid over the year.

Gross Earnings YTD: The total gross pay you have received since July 1st. In Jane’s case, this is $14,625.

Tax YTD: The total amount of tax that has been withheld from your pay since July 1st. Jane has paid $1,392 in tax so far this financial year.

Super YTD: The total amount of superannuation your employer has contributed for you since July 1st. Jane’s employer has contributed $1,755 to her super fund.

The YTD figures are beneficial when it comes time to lodge your tax return, as they give you a clear picture of your total income and tax paid for the year.

Why Understanding Your Payslip Matters

Being able to read and understand your payslip is a critical skill. It helps you ensure you’re being paid correctly, track your tax obligations, and monitor your superannuation contributions. If you ever notice something that doesn’t look right on your payslip—such as missing hours, incorrect rates, or missing super contributions—don’t hesitate to speak with your manager or your workplace’s payroll department.

Understanding these key terms will help you feel more confident about your finances and ensure you are being paid correctly.

Disclaimer: This article provides general information and does not constitute financial advice. Please consult with a professional for advice tailored to your specific circumstances. Information is current as of November 2025.